Fintech Startups Shaping the Future of Finance

The financial technology (fintech) industry has been rapidly evolving and reshaping the way people manage their finances. Fintech startups are at the forefront of this revolution, leveraging technology to create innovative solutions that are disrupting traditional banking and finance sectors. These startups are not only changing the way we transact and manage money but also opening up new opportunities for financial inclusion and accessibility.

Empowering Financial Inclusion

One of the key ways fintech startups are shaping the future of finance is by promoting financial inclusion. Through the use of mobile technology and digital platforms, these startups are reaching underserved populations who have limited access to traditional banking services. By providing alternative financial solutions, such as mobile banking and digital wallets, fintech companies are enabling people in remote areas to participate in the formal financial system.

Additionally, fintech startups are developing solutions to address the needs of unbanked individuals, offering them access to credit, savings, and insurance services that were previously out of reach. These initiatives are not only improving financial literacy and stability among marginalized communities but also driving economic growth and empowerment.

Enhancing User Experience

Another significant impact of fintech startups is the focus on enhancing user experience in financial services. Traditional banks have long been criticized for their cumbersome processes, long wait times, and lack of transparency. Fintech companies are changing this narrative by offering seamless and user-friendly digital platforms that make managing finances a breeze.

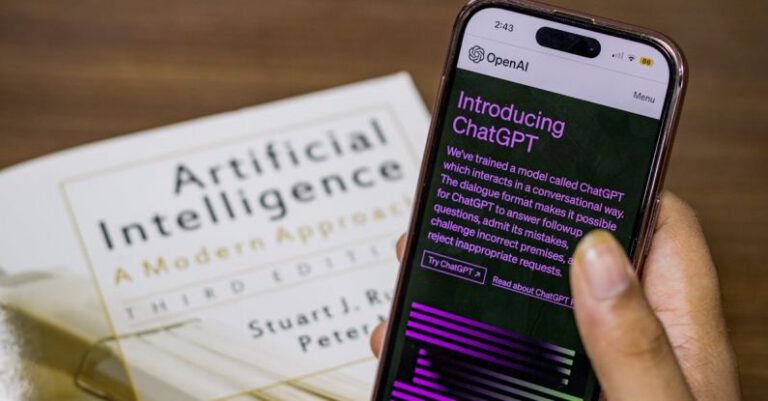

From intuitive mobile apps for budgeting and investing to automated wealth management tools, fintech startups are putting the power of financial control directly into the hands of consumers. By leveraging data analytics and artificial intelligence, these companies are able to personalize financial services and provide tailored recommendations to help individuals make informed decisions about their money.

Driving Innovation in Payments

Fintech startups are also driving innovation in the payments sector, introducing new ways for people to transfer money, make purchases, and conduct transactions. The rise of mobile payment solutions, such as digital wallets and peer-to-peer payment apps, has made it easier than ever for individuals to send and receive money in real-time.

Moreover, the adoption of blockchain technology by fintech companies has revolutionized the way cross-border payments are handled, reducing costs and processing times significantly. Cryptocurrencies and stablecoins are increasingly being used as alternative forms of payment, offering a decentralized and secure method for conducting financial transactions globally.

Challenges and Opportunities Ahead

While fintech startups have made significant strides in reshaping the future of finance, they also face challenges that need to be addressed. Regulatory compliance, data security, and customer trust are some of the key issues that these companies must navigate as they continue to grow and expand their operations.

Nevertheless, the opportunities for fintech startups are vast, with the potential to disrupt traditional financial institutions and create a more inclusive and efficient financial ecosystem. By staying agile, innovative, and customer-centric, these startups will play a crucial role in shaping the future of finance for years to come.

In conclusion, fintech startups are at the forefront of transforming the financial landscape, offering innovative solutions that empower individuals, enhance user experience, and drive innovation in payments. As these companies continue to evolve and adapt to changing market dynamics, they are poised to shape the future of finance in a way that benefits consumers, businesses, and economies worldwide.